we can help:

Make more money, invest better and reach your financial goals.

No matter where you come from or at what stage you are in your financial journey, we are here to help.

hand-picked content

Featured Posts from the blog

-

The Holy Grail of Trading: Patience and Acceptance

Trading in financial markets, especially day trading, requires a strategic blend of technical skills and psychological fortitude. Among the most crucial aspects of successful trading is the ability to exercise patience and acceptance. This article delves into the concept of the “Holy Grail” in trading and elucidates the importance of patience, particularly in day trading.… Read…

-

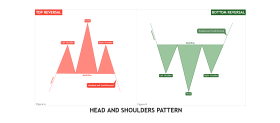

Creating Reversal and Trend Continuation Strategies with Indicators

In this tutorial, we’ll explore how to create both reversal and trend continuation strategies using a variety of indicators. We’ll use the given reference parameters to structure effective strategies for different timeframes and markets, primarily focusing on M1, M5, and M15 indices. Each strategy will be named and IDed for journaling and performance review. Table… Read…

-

Lot Size, Leverage, Profit & Loss in Forex Trading

Choosing a Lot Size in Forex Trading Choosing a lot size in Forex trading is essential for successful trading. There are several options for you to consider, including a standard lot of 100,000 units, a micro lot of 10,000 units, and a nano-lot of one unit. Each type of lot size has different characteristics. For… Read…

-

Is Forex a Pyramid Scheme?

If you’ve been in the FX market for any length of time, you’ve probably heard stories about scams and the Forex market being a pyramid scheme. While these stories aren’t true, they can leave you with a bad impression about the whole process. Fortunately, there’s no need to worry – forex is not a scam.… Read…

-

What Are Forex Majors and Minors?

Forex markets are divided into four main categories. There are three main types of currency pairs – majors and minors. The majors are highly liquid and traded often, while the minors are less liquid but still trade frequently. Each category has its own pros and cons, so a thorough understanding is necessary before you begin… Read…

-

Forex Trading Vs Stock Trading

When deciding between stocks and forex, it’s important to know which is more volatile, which has more potential for profits, and which is less volatile. The stock market has millions of publicly traded companies, making it difficult to monitor their performance. In contrast, the forex market is highly specialized, with eight major currencies. A company’s… Read…

-

The Holy Grail of Trading: Patience and Acceptance

Trading in financial markets, especially day trading, requires a strategic blend of technical skills and psychological fortitude. Among the most crucial aspects of successful trading is the ability to exercise patience and acceptance. This article delves into the concept of the “Holy Grail” in trading and elucidates the importance of patience, particularly in day trading.… Read…

-

Creating Reversal and Trend Continuation Strategies with Indicators

In this tutorial, we’ll explore how to create both reversal and trend continuation strategies using a variety of indicators. We’ll use the given reference parameters to structure effective strategies for different timeframes and markets, primarily focusing on M1, M5, and M15 indices. Each strategy will be named and IDed for journaling and performance review. Table… Read…

-

How Much Money Can I Make Forex Day Trading?

The Forex market is a five trillion dollar per day business, and the majority of traders lose money. Most do not understand the risks and do not know how to manage them. However, those who succeed are likely to earn at least $100 a day. Even if you start with a small investment, you can… Read…

-

The Holy Grail of Trading: Patience and Acceptance

-

Creating Reversal and Trend Continuation Strategies with Indicators

-

Lot Size, Leverage, Profit & Loss in Forex Trading

-

Is Forex a Pyramid Scheme?

-

The Holy Grail of Trading: Patience and Acceptance

-

Creating Reversal and Trend Continuation Strategies with Indicators

-

Lot Size, Leverage, Profit & Loss in Forex Trading

-

Is Forex a Pyramid Scheme?

-

The Holy Grail of Trading: Patience and Acceptance

-

Creating Reversal and Trend Continuation Strategies with Indicators

-

Lot Size, Leverage, Profit & Loss in Forex Trading

-

Is Forex a Pyramid Scheme?