Money may be difficult to come by in the forex markets—or any other kind of transaction for that matter. However, owing to a variety of chart patterns, you can learn to predict price fluctuations and take action. It doesn’t have to be difficult to make money.

The problem is that there are so many patterns to choose from that it may be difficult to know which ones are the greatest predictors of future price movements.

To assist you out, we’ve included a list of some of the most often used continuation and reversal patterns below. To make better transactions, get to know them all.

Head & Shoulder Forex Chart Patterns

One of the most common patterns in Forex is the head and shoulders. As the name implies, a head and shoulder pattern looks like a person’s body structure. Financial instruments (e.g., currencies) attain highs during an uptrend, encounter resistance, and return to the trend line (i.e., neckline) before reaching yet another high and returning to the trend line. Finally, they fall below the trend line.

After drawing two shoulders and ahead, the pattern appears like a two-headed creature. Trading this pattern effectively may lead to many wonderful trading chances for those who are acquainted with it.

On top of it, there is an inverted head and shoulders pattern that looks just like the original. During a decline, there are three stages: the low (the first shoulder), the head, and the tail. As a result of this, the financial instrument returns to the trend line, then reverts back and closes above it. This is referred to as a breakout.

Forex Chart Patterns Wedges that Rise and Fall

Wedges, or triangles, are one of the most prevalent formations on forex charts. These patterns are formed when price fluctuations grow progressively constrained before ultimately bursting free of their confines.

When rising wedges form, it is a sign that a downward trend is about to begin. In times of rising price consolidation, they are more likely to occur. After multiple highs and lows, the price drops below the trend line. However, falling wedges are often seen as a sign of an upcoming rise. After many lower highs and lower lows, a financial instrument ultimately reaches the trend line.

Double-Top and Double-Bottoms Forex Chart Patterns

When a currency is in an uptrend, it may be impossible to break out over a certain level of resistance on two successive times. A double top design is what you have here. If the second top isn’t broken, there’s a significant likelihood that the price will begin to decline.

In contrast, if the price makes two bottoms in a row, it may be indicating that the price is ready to begin an upward trend. During downtrends, this pattern happens when the price fails to break below a level of resistance two successive times. There may be a spike in price once the second bottom is not broken.

Flags of the Bull and the Bear Forex Chart Patterns

There are bull and bear flag patterns that appear when the market is unsure of itself. Let’s imagine that the value of a currency is rising (the flagpole). During a time of consolidation, the price may stagnate or even fall somewhat, but for the most part, it stays stable (the flag). Once that time period is through, the price is likely to resume its prior upward path.

In contrast, a bearish flag appears when the price is moving downward (the flagpole). Even while the price may rise a little during a time of consolidation, the overall trend stays the same (the flag). It is common for an instrument to continue downward after a consolidation.

You can earn a lot of money if you can detect these trends and anticipate with some degree of certainty when a price is due to rise or fall.

Engulfing Forex Chart Patterns

These patterns, which are quite simple to see and recognise, emerge when a candle is so large that it covers the previous day’s candle in its true body.

After a downturn, a bullish engulfing candle will envelop the true body of the previous day’s candle. Following an upswing, bearish engulfing happens when the previous day’s true body is completely engulfed by a down candle.

In either direction, patterns that envelop a previous day’s movement suggest a breakthrough, which may be either bullish or bearish.

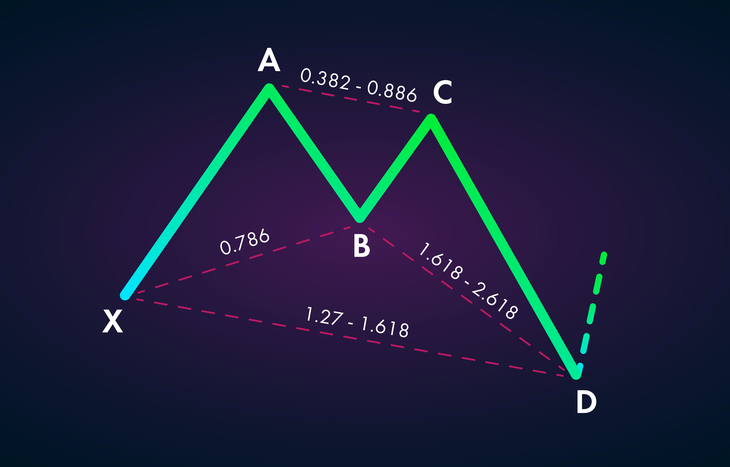

Butterfly Forex Chart Patterns

Although the butterfly design seems to be difficult to decipher, it is really rather simple. Following a high or low from the X point of the ABCD pattern and subsequent reversals that correspond to Fibonacci extension ratios, it shows an ABCD pattern. There are two triangles, or wings, meeting in the centre at “B” point in the design.

You may also get a bullish or bearish butterfly pattern by looking for a “M” or “W” in the middle of the motif.

When this pattern emerges, it is frequently a strong signal that the price movement is likely to continue in the same direction as it has been heading.

When this pattern emerges, it is frequently a strong signal that the price movement is likely to continue in the same direction as it has been heading.

The “handle” portion of the pattern comes when the price reverts to its previous value, producing the “cup.” A retracement of 30 to 50% is usual for this handle, although outliers are conceivable. This is a powerful bullish signal, particularly if it develops over a period of many months. The bullish indication isn’t as dependable when things are moving swiftly or over a lengthy period of time.

Forex Chart Patterns Bullish & Bearish Pennants

In forex trading, a pennant is one of the most common patterns, and it often occurs after a flagpole and contains a period of consolidation before a breakout may occur.

The pennant pattern is the result of a period of consolidation. When trading pennant patterns, use other indicators to predict the breakout direction, and then set a stop-limit order on the opposite side of the breakout to minimise your losses in the event that the breakout proceeds in the incorrect direction.

The Top Is Widening

An expanding top is defined by five small reversals followed by a significant drop. Remember that the new high or low is more severe than the previous high or low. Because of this expanding shape, in most circumstances, a negative trend may be expected. The sixth reversal and ascent beyond prior highs in the pattern reveal a likely expanding top formation in the process, even if it first seems to be a butterfly pattern developing. This pattern will be confirmed if the lower trend line established by “B” and “D” is broken.

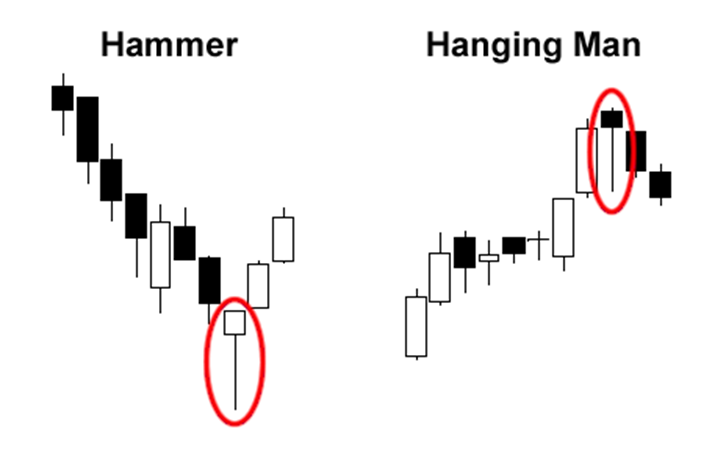

Forex Chart Patterns Hammers

To indicate a currency pair’s “bottom,” the hammer may be utilised as a single candlestick pattern. Traders may consider this price’s lengthy wick at the bottom as a signal to initiate a position ahead of the upcoming activity.

Bottom-Rounding

It is possible to detect market moves that might lead to either a reversal or continuation by using the rounding bottom. Use this pattern in combination with other technical indicators to get a better sense of where the price is headed.

Having a stop-loss in place when you start a trade after a rounded bottom has been established is a good idea. There are many different ways of using trailing stop-losses to protect your earnings while you wait to see if the pattern will either reverse or continue.

Some traders may choose to look for a “zenith” pattern, in which the price peak is indicated by an exceptionally long wick above the candle, in order to predict a price decline.